The Complete Guide to Mac Bookkeeping Tools

If you’ve just made the leap from employment to freelancing or small-business ownership, or even if you’ve been doing it a while now, you’ve probably discovered the massive drain of keeping your accounts in order. It was all so simple when a different department was in charge, wasn’t it? Suddenly invoicing, payroll, tracking tax payments, and listing expenses seems to be taking up all the time you should be spending running your business.

Timing is all about saving you time; it’s what we live and breathe for — so you’re in luck. We’ve put together a complete guide to Mac Bookkeeping Tools for small and medium businesses. So if you’re finding that when you review your day a large chunk of your time is going into your accounts, we’re about to save you from that. We’ve mainly focused on cloud-based accounting software — the benefit of which is that it’s accessible from anywhere and on any device, and you need to worry less about keeping that data backed up. Small business accounting software which isn’t in the cloud can suck up too much time and money. Imagine billing yourself at your hourly rate for your accounts. Is it worth it?

Cloud-based

Intuit QuickBooks for Mac

Image: Intuit

QuickBooks has, for a long time now, held the top spot in cloud-based accounting software. Since it was launched in 1983 if you know anything about accounting software, you’ll have heard of Quicken, Intuit’s first product. In 2004, Intuit launched QuickBooks online, meaning they have had well over a decade to perfect its product. Like most cloud-based software, you can use the app on any device and login from anywhere, making your accounts a breeze.

Pros

QuickBooks currently has over 500 third party integrations, from payment gateways to time-tracking software and retailer platforms. This means that it will feel seamless to use with the software you’re currently using. All packages also include accountant access — even for the one-user plan. So there’s no need to upgrade just to get your books taken care of.

Cons

Since their recent upgrades, there has been a lot of criticism about the usability and intuitiveness of the platform. By far the biggest complaint, however, is about poor customer service — a complaint that simply can’t be underestimated in today’s competitive market. If QuickBooks want to maintain their foothold as one of the main players in accounting software, this is something they need to sort out, and fast.

Cost

QuickBooks offers a 30-day free trial for you take it for a test drive, just be careful to not spend too much time inputting data if you don’t intend to go pay up for the full version. Prices range from $15 to $31 a month, but keep an eye out for sales that offer you a 12 month discount.

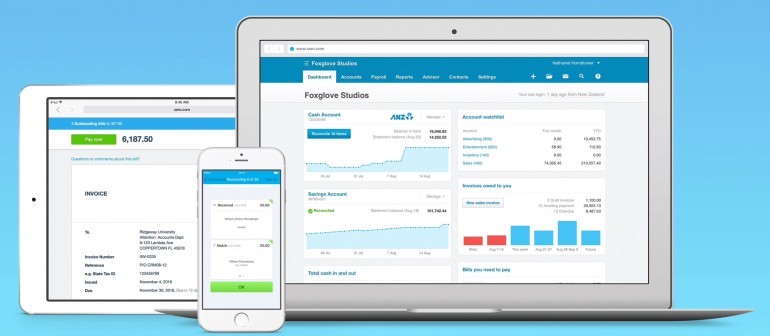

Xero

Image: Xero

Xero’s tagline is ‘beautiful accounting software,’ and it certainly lives up to that. The New-Zealand based cloud accounting software is hot on QuickBooks’ heels and may soon become the leader in cloud-based accounting services. Why? It’s intuitive, easy to use, and delights the eye with its quirky and pleasant design. They’ve also been named Forbes’ most innovative growth company of the year twice, meaning that they’re coming up in the world.

Pros

Like QuickBooks, Xero also has 500+ possible integrations. You also can have unlimited users, meaning you can add your team members at no extra cost. According to customer reviews and comparisons, the biggest plus of Xero over QuickBooks is that it’s easier to use and has better customer support.

Cons

While most people are happy with Xero, with some even saying it’s ‘fun’ to use (although I use it myself and until accounting resembles a Super Mario game, I will never call it fun), there’s still some criticism. Its advanced capabilities mean that there’s a learning curve to use the software properly, and the biggest complaint is that the mobile app has poor functionality.

Cost

Xero also offers a 30 day free trial, so you can test for yourself how fun it is. Like QuickBooks, there are frequent sales, so when you do sign up make sure you get a discount for the first three months.

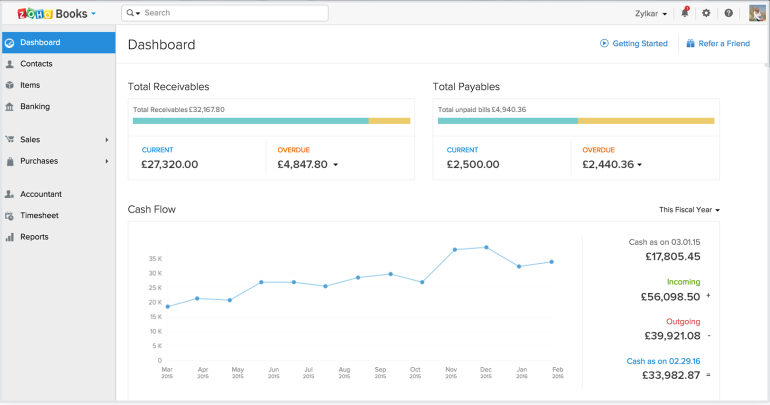

Zoho Books

Image: Zoho

If Xero and QuickBooks are the two big boys in the playground right now, then Zoho Books is the feisty underdog vying for position. Still relatively new on the accounting software scene, in the past few years it’s made leaps and bounds — albeit, still not enough to have become a household name. Xero and QuickBooks need to look out, as Zoho Books is a worthy opponent thanks to its usability (something both have been criticized for) and affordability.

Pros

The majority of Zoho Books reviews are extremely positive, with users praising its invoicing customizability, ease of use, and great customer service.

Cons

So far, there are very few complaints about Zoho Books, but if you have a larger business — or if you plan on scaling your business to being larger in the near future and don’t want the hassle of changing over — then it’s probably best to stick with one of the other options thanks to the lack of payroll. One common complaint is lack of integrations — possibly because they’re still relatively unknown.

Cost

Zoho Books is very affordable, starting at only $9 and going up to $29. You can try it with all the bells and whistles free for 14 days by clicking here.

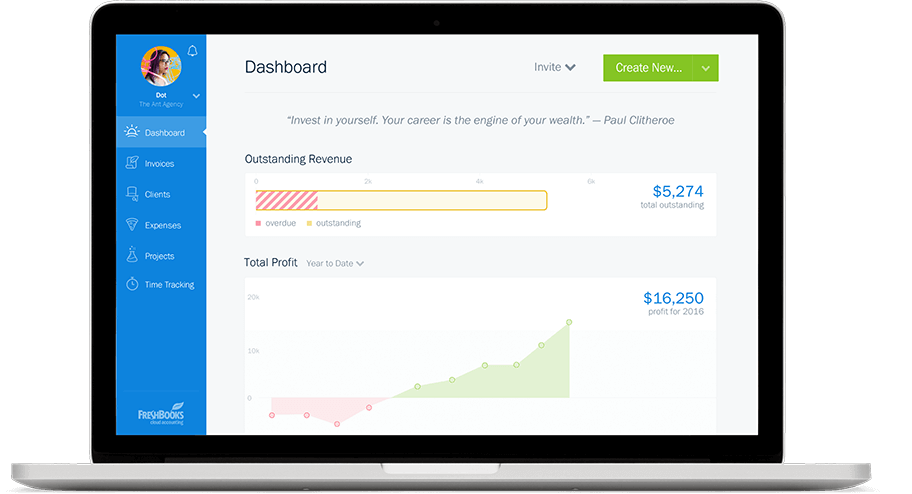

FreshBooks

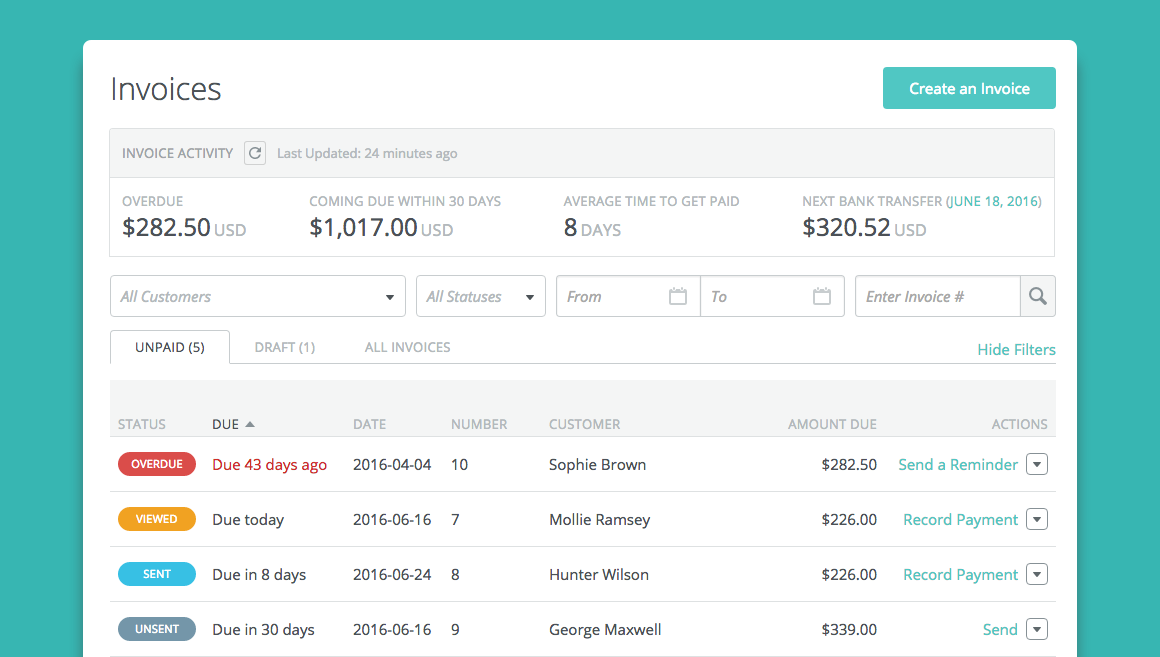

Image: FreshBooks

FreshBooks continually comes out on top of Finances Online’s best accounting software, thanks to its scalability and ease of use. Over 10 million people around the world are currently using it, which is testimony to its power as an accounting solution. Rather than trying to over-complicate things, FreshBooks provides the core accounting toolset, such as invoicing, expenses, time-tracking and payments.

Pros

FreshBooks has a simple, easy to use, and beautifully designed interface, making it easy and pleasant to use. It’s also extremely scalable — so if your business grows, you’re not going to be hit with a huge fee to add extra users or clients.

Cons

The biggest con by far is that, despite the name, FreshBooks isn’t really a complete accounting software. There’s no double ledger and no way to gain a full overview of your financial state. For small businesses who just need invoicing/billing and want something that’s quick to use, this might be fine, but once you have a lot of incomings and outgoings you could find that it’s not powerful enough.

Cost

Plans are $15, $25, and $50, and for $10 a month more you can add extra users. You can find a free trial here.

Wave

Image: Wave

Wave is a free — yes, you read that right, free! — accountancy software. Their promise to their users is that they always have been, and always will be, free. Despite this, it offers a decent set of features like several professional and customizable invoicing templates, expense tracking, multi-currency, etc. There are a few small paid upgrades, like payroll support, but they’re neither hidden nor extortionate.

Pros

Did you hear me say it’s free? Aside from that, another plus is that you can manage your personal and business accounts in the same place. Additionally, the integration with Zapier, and thereby access to Zapiers 500+ integrations, has fixed the common complaint about lack of integrations.

Cons

Wave generally has positive reviews, but a common complaint is that it can be very slow and has a lot of downtime. There are also complaints about limited features, like limited reports.

Price

Totally free, and you can download it here.

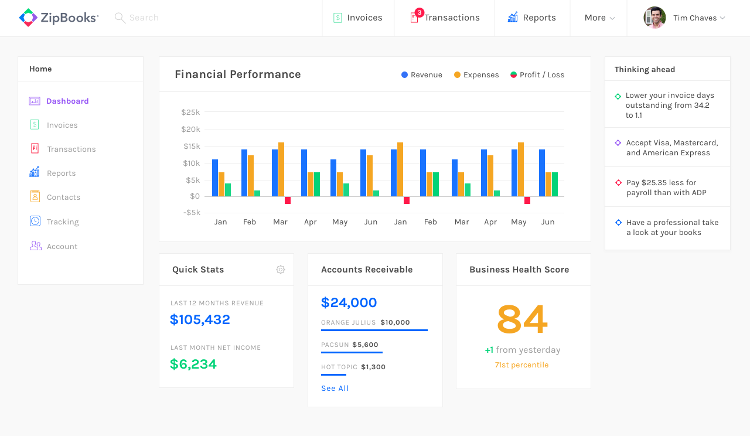

ZipBooks

Image: ZipBooks

ZipBooks is still a baby when it comes to accounting software, arriving on the scene in 2015. Possibly a little late to the cloud-based party, they have tried as hard as possible since then to make a name for themselves with intuitive features, and excellent customer support. This simply means it’s growing fast, since they listen to suggestions and make changes which is vital for new companies.

Pros

Excellent customer support means that ZipBooks is expanding fast. It also offers a free version with limited features, meaning it’s great for anyone just starting out. ZipBooks also has the option to hand your accounts over to their inhouse accounts team, for an extra cost. So y

Cons

Still new, ZipBooks has a limited number of features and functionality. If you’re a freelancer with aspirations, there’s a solid chance you’ll outgrow it at some point.

Cost

ZipBooks Starter is free, and the packages are then $15, $35, or $125 a month if you want a bookkeeper. Give it a try here, and see if it adds some zip to your life.

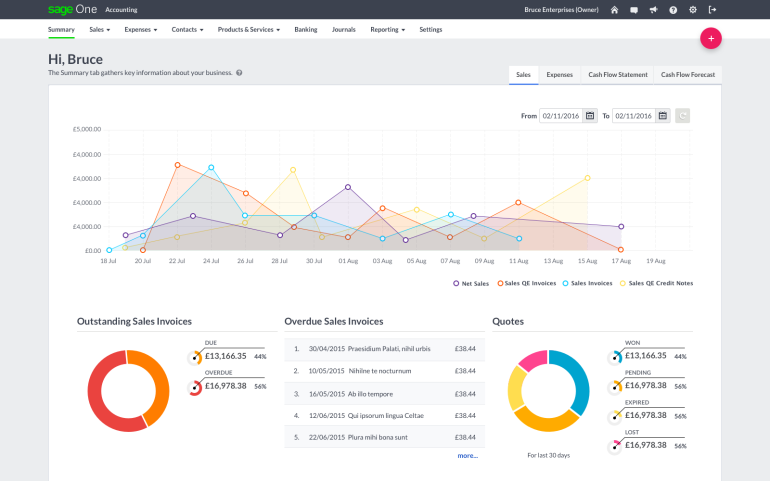

Sage One

Image: Sage One

Sage One. Kind of makes you think of ‘old sage one,’ or that person who knows all but is a bit ancient. You wouldn’t be wrong applying this assumption to Sage One the accounting software, as it’s the grandfather on this list, being founded in 1981 in the UK. Since then, it’s grown to a modest 230,000 users. It’s now cloud-based and trying to keep up with the new software on the market.

Pros

Sage One is praised as being easy to use, even if that comes with limited features as a compromise. The customer support is extremely responsive and friendly, which is another major plus. Depending on which country you’re in, the site seems to change to different versions — a nice but unusual customization that caught me by surprize.

Cons

If you’re based in the US — or have employees there — then forget Sage One, as there’s no US payroll support. Perhaps one of the reasons why Sage One has only grown to the modest size is that it has is a strong bias towards the UK/EU market.

Cost

A major pro of Sage One used to be that it offered a free version, but that has now been removed. Having said that, the new prices hardly require a second mortgage. A monthly subscription is $25, and there are often half price sales. Find the right region for your business, and give the free trial a whirl.

Locally Installed

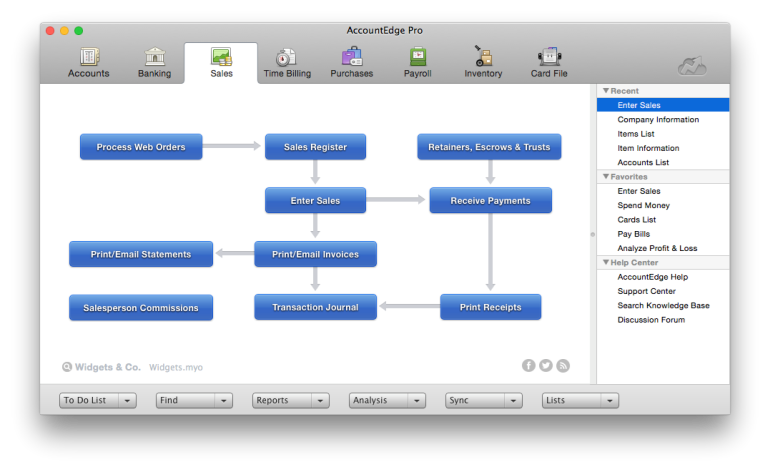

AccountEdge

Image: SoftwareConnect

A popular option for accounting software that’s locally installed, rather than cloud-based, but still designed for Mac is AccountEdge. If you take the time to learn to use it, AccountEdge can be an extremely powerful desktop option for handling your accounts. If you’re not so set on using the cloud, then this is the option for you. AccountEdge stays competitive, while also staying in one place on your computer.

Pros

The one-off payment means that it can be economical for small business users, and the interface stays true to traditional double-entry accounting. If you’re not too comfortable with the transition to digital accounting, then having an interface which resembles pen and paper books could make the transition more pleasant.

Cons

After the one-off payment, you may find yourself having to continually pay to upgrade for features. So make sure you pick the right plan for you, or it could turn out more expensive. As with many of the others on this list, one of the most common criticisms is that there’s a steep learning curve to proficiency of use.

Cost

AccountEdge offers a 30-day free trial before you need to commit, so you can try before you buy. Once you’re ready to commit, there are three plans to choose from. Basic, Pro, and Pro-Network, from $249-$399 excl. VAT. You’re also paying a yearly service agreement for yourself and any subsequent users you add, which is almost as much as each of the packages.

Conclusion

There’s little doubt that if you use a Mac, then cloud-based accounting is the way to go. From personal experience, I can recommend Xero, but it takes commitment to learn the ins and outs and make sure you’re getting the most for your money. If you’re just starting out, then Wave, Sage One or FreshBooks might be a good option, as they’re budget friendly and quick to learn. If you’re looking to expand, though, then Xero or one of the other larger tools is worth putting the time and money into. And if you really don’t want to deal with cloud-based software, but still want a tool which works well on a Mac? AccountEdge is the one for you.

Are you feeling excited to do your accounts yet? If you’re torn between a few options on this list, make sure you take the time to make use of the free trials and learn how to use them. Investing time in an accounting software, then having to change completely, is definitely not time well spent. Putting in the time to decide now is an investment for the future of your business. Get your financial system in place, and you’ll find the rest will follow.