Billable Hours and Non-billable Hours: How Time Tracking Tools Can Help You Find Balance

Allocating your time correctly is a freelancing necessity, and that means understanding and knowing how to manage your billable hours and non-billable hours. More than that, you need to be able to find the right balance between the two.

Billable hours are important, they’re the money generators. But they’re often only possible because you’ve spent non-billable time working on marketing your business and refining your sales pitch. Non-billable hours, however, don’t earn you any direct income. So while they’re often critical to your business growth, it can be hard to tell whether they’re worthwhile and to what extent.

Figuring out how to make your billable and non-billable time work for you can be tricky, but it’s not impossible. And getting it right can help to maximize your productivity, remove inefficiencies in your business, and boost your bottom line. We’re here to show you how.

Table of Contents

Firstly, what are billable hours and non-billable hours?

Heard the terms bandied about but not quite sure what they mean? Let’s define them upfront.

Billable hours

Billable hours are the hours you work that are directly related to your projects. They refer to the core activities of your business. As the name suggests, they’re the hours that you bill, or invoice, to your clients once some or all of the work is complete. They might include:

- Conducting research and gathering background context

- Drawing up project plans and timelines

- Performing the work you’ve been hired to do

- Attending meetings and interviews

- Implementing changes that your client has requested

If you’re a web developer, your billable hours would include the time you spend planning, designing, and coding a website. If you’re an accountant, you would invoice for the time it takes to analyze a client’s financial affairs, audit their finances and accounts, and make recommendations.

Non-billable hours

Non-billable hours refers to the time you spend on work-related tasks that you can’t bill to your clients. They’re still work, but it wouldn’t be appropriate to include these hours as line items on an invoice. They include:

- Developing proposals and pitches

- Marketing your business in person or online

- Taking training courses or attending events to improve your skills or knowledge

- Quoting, invoicing, processing payments, and other administrative tasks

- Fixing errors you made that the client isn’t responsible for

- Working beyond the scope of the project

In most cases, these hours are well spent. You could walk out of a non-billable networking event with potential new clients, and a well-curated pitch could land you a major contract. But you can’t always prioritize non-billable work over the work that’s actually helping you put money in the bank. There needs to be a balance.

(Remember, there also needs to be a balance between the hours you work and the hours you don’t work. Today, work-life balance matters more than ever. A 2022 report by the American Psychological Association revealed that 79% of respondents said they’d recently experienced work-related stress. Some 32% reported emotional exhaustion, 36% cognitive weariness, and 44% physical fatigue. Your billable and non-billable hours only apply to your working time — you need to have time off, too.)

How many billable hours vs non-billable hours should you work?

Fortunately, someone’s done the math here. It’s called the utilization rate and it can be calculated in either dollar or hour terms:

Utilization rate = Direct labor ($) / Total labor ($)

Billable hours / Workday hours

Ideally, your utilization rate should lie between 60 and 80%. That means that up to 80% of your time should account for billable work (for many, this can be a pretty tough target to meet). The remaining 20% or so can, and even should be, non-billable time.

How to keep track of billable hours vs. actual hours

Having a goal to aim for is useful, but how do you actually know how many billable hours you’re working?

Do you simply guess? Try and remember how long a similar project took you to do in the past and quote and invoice accordingly? That’s certainly one way of doing things, but it’s probably not the best. You could well end up underestimating your time and short-changing yourself.

A more accurate way would be to track your time using a time tracking app. A dedicated piece of software running in the background will give you a more reliable indication of how long a task has taken than your memory or a manual Excel spreadsheet. And with reliable information on hand, you can guarantee that your quotes and invoices are fair both to your clients and to you.

Why you should track your non-billable hours, too

We don’t mean to imply that your time tracking app should only monitor your billable work, however. On the contrary, it’s a good idea to keep an eye on where your non-billable time is going, too. Why? Because:

- You can learn the real value of your time. If you charge a client $50 an hour for work, but it took four hours of non-billable preparation to earn that amount, then your hourly rate is really closer to $10 an hour. This might be worthwhile initially, but it isn’t sustainable in the long term.

- You can spot which clients are taking up more non-billable time than they should. This information can help you renegotiate your contract, or even encourage you to step away from certain clients and invest in those that are more profitable.

- You can identify repetitive and time-consuming tasks, and find a way to automate them using the right software.

How to reduce the non-billable hours of your actual hours

Keeping your billable hours high involves keeping your non-billable hours low — at least, as low as you can without eliminating the important and necessary work that this time can hold. Here are a few billable hours best practices to help you drop your non-billable hours or, better yet, incorporate them into your billable time.

1. Decide what’s billable and what’s not

The difference between billable vs non-billable time isn’t always clear cut. Does driving to a client meeting count as billable time, for example? What about a brief phone call? And what happens if a client cancels a scheduled meeting? Do you charge them for the time you could have spent doing something else?

Unfortunately, there’s no universal answer here. What you charge — and what you charge for — is up to you. Be guided by what feels ethical and authentic, what your clients will accept, and what the norm is in your industry. Lawyers and consultants are notorious for charging for every minute they spend on a project, and some businesses add a flat admin fee to every invoice. This isn’t to say you should mirror these approaches, but be conscious that you’re not letting billable time slip away from you.

If you are going to charge for canceled meetings, however, make sure that you communicate this clearly to your clients upfront, and that it’s outlined in your contract. Unexpected costs can sour even established relationships.

2. Use automatic time tracking software

We’ve mentioned this one before, but we’ll say it again. Tracking your time is one of the best ways of keeping a firm handle on your billable hours, and helping you to see how much time you’re spending on work you’re not getting paid for.

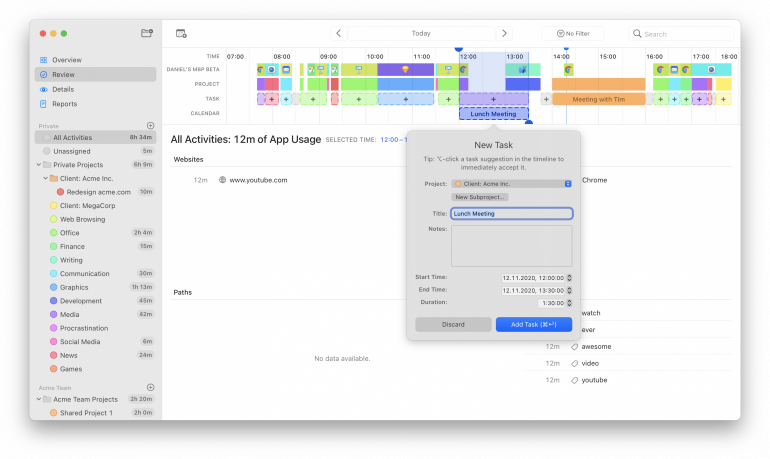

Those late-night emails, that “it will only take a minute” task — they add up. Potentially to hours’ worth of work. Without automated software, it’s impossible to know exactly where every minute is going. Tools like Timing help you capture every detail, including which app, website or document you were using, and for how long. Simply allocate them to your projects or clients, and refer to your reports when you’re ready to invoice.

![]()

3. Manually add what you can’t track automatically

Work doesn’t stick to office hours anymore, nor to a single device. An after-hours phone call with a client still counts as billable time, even though you’re not in front of your laptop. So does an on-site visit, or some to-ing and fro-ing over Slack.

Don’t let these minutes and hours that you could be billing for disappear into your non-billable tally.

Use Timing’s Screen Time integration feature, for example, to import your iPhone and iPad usage directly from Screen Time. This helps you spot every billable phone call, WhatsApp message, or email you send on the run. Between this feature and Timing’s web app, you can always have an overview of the time you spend away from your desk.

You can also add entries manually to your time tracking tool. If you do, be as detailed as you can in how you categorize them. This will not only help you keep your reports accurate, but will also give you a useful indication of how much billable time you spend elsewhere, such as attending in-person meetings. (Timing will prompt you for details on what you’ve been up to when you return to your desk so that nothing gets missed.)

4. Make your time tracking work for you

You want time tracking software that works for you — it can’t be yet another task that eats up your non-billable time. Establishing rules so that you don’t have to categorize every project manually can help to optimize this process.

Maybe there’s a particular programme that you only use for one client: set up a rule that says that auto categorizes all work in Hootsuite for the one client whose social media you manage. Or get more specific, and assign anytime you spend on a particular website for the client you provide advertising services to.

In Timing, these types of categorization rules are easy to set up. Simply drag an activity to permanently assign it to a task. This will save you hours of categorizing things manually, and makes starting and stopping timers a thing of the past.

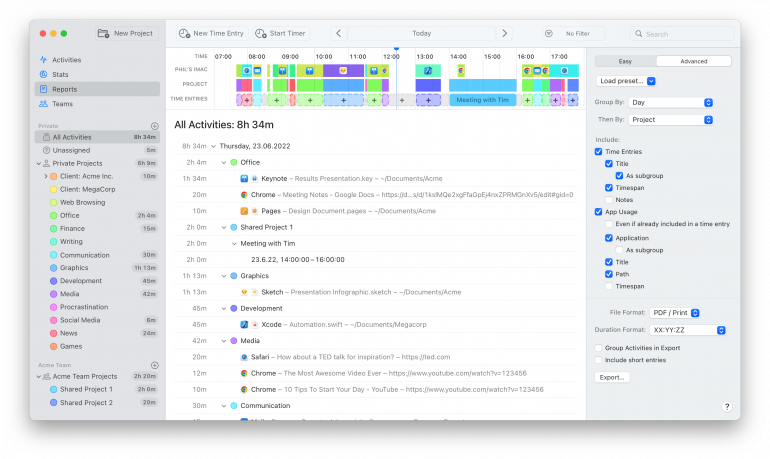

5. Rely on your reports

Your time tracking reports are valuable tools: they give actionable insight into how you’re spending your time, what you’re billing for, and whether you’re profitable. They also help you identify missed opportunities — are you neglecting to bill for time that you should be paid for?

Every week or every month (ideally before you invoice), make sure the total amount of working time in your reports equals the total amount of time you billed. Also look for activities and tasks that haven’t been assigned to a project. Can these activities still be billed to a client? If so, add them. If not, try and remember to look through your reports more regularly, asking yourself why you missed them in the first place. Correcting this can help to bump up your billable hours, and ensure you’re paid fairly.

6. Optimize your non-billable time

Once you’ve eliminated as many non-billable hours as possible (either by turning them into billable hours or finding ways to avoid them), your next step is to optimize the non-billable time that remains. Look at your non-billable activities, and ask yourself whether you can streamline or automate them.

Creating a template for your proposals would likely make the pitching process quicker, for example, and bookkeeping software can help you to quote, generate invoices, and track payments faster than a manual system. Some solutions simply involve rethinking how you work: you might choose to be really selective about the meetings you accept, especially if you can’t bill for them.

7. Re-evaluate your rates

If you’ve reduced your non-billable hours and you’re still feeling like you’re not making what you should, consider raising your rates.

How much should you raise them by? First, look through your time tracking software to determine how much time you spend on billable vs non-billable hours. Then, divide your non-billable hours by your billable hours to determine the percentage you need to make up.

Price increase = Non-billable hours / Billable hours

If you’re spending 34 hours a week on billable time, for example, and 6 hours on non-billable work, then 6 divided by 34 is 0.176, or about 18%. Raising your rates by 18% would compensate you for the non-billable time. Take a look at this figure and decide if it’s fair to your clients, or fair to every client, before you inform them of your rate increase.

Start tracking your time today

Keeping a firm grasp on your billable and non-billable hours can help you to be more productive, invoice correctly, and ensure the success of your business.

While there are many ways to find a balance between the two, they all start with knowing exactly where your time is being spent. With that information in hand, you can start to take steps to make sure you’re working as effectively and billing as much as you can.

Ready to bill more hours? Start by taking control of your time with automatic time tracking. Download your 30-day free trial today.