Handling a Client Payment Dispute

Being a freelancer means you’re your own boss, right? Yes! Well, sort of.

Even though you are technically your own boss, you still have to answer to and impress clients—plus abide by their timelines.

Depending on the kind of freelance setup—maybe you do many projects for a multitude of different clients, or perhaps you spend the majority of time freelancing for one—it may sometimes feel like someone else is running the show.

No matter the situation, there will always be someone you are reporting to in some capacity, even if it’s just to receive and hand off assignments.

Being that this is a bit of a unique scenario compared to most manager-employee relationships, it can feel a little awkward when a payment dispute comes about. (Who enjoys conversing—and especially arguing—about money? Yuck.)

However, it’s your livelihood we’re talking about! It’s a big deal, and we’re sure it means a lot to you. That’s why we took a deep dive into those pesky potential payment disputes and have provided our advice and solutions.

How Payment is Different

If you are a full-time employee, you likely are set up to receive direct deposit, or eagerly await a check to land on your desk or in your virtual mailbox every two weeks in accordance with an agreed-upon salary.

Unless you are able to account for overtime or are reimbursed for work-related expenses, you usually know exactly what is hitting your bank account and when. Because of this, your company’s internal finance department or a third-party vendor probably has automatic payment schedules, so you usually don’t have to worry about any roadblocks or mistakes (except for the occasional tech glitch, of course). Payments are predictable and dependable.

However, as a freelancer, this can be a bit more of a free-for-all. Though you may have certain terms in your contract to get paid within a specific amount of time (perhaps 30 days), that doesn’t necessarily mean it’s going to happen.

It means the sometimes uncomfortable situation of following up on late or missed payments, maybe even dragging on to the point where you have to threaten to cease work until the situation is resolved. (Yikes!)

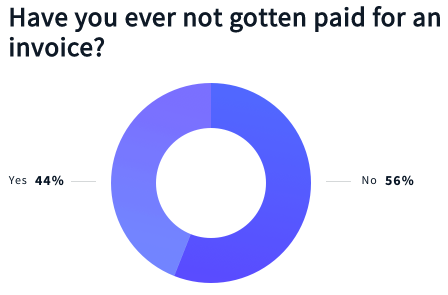

As a study conducted by AND CO found, “44% of respondents told us they’ve been stiffed by a client before. Nearly half of respondents who had been stiffed said the reason was that companies don’t take freelancers seriously. Another 35% blamed vague or shoddy freelance contracts for not getting paid.”

Source: www.and.co/slash-workers

Late Payments

Regardless of your mutual terms, it can be a real punch in the gut to not get paid on time by a client. After all, you have bills to pay and responsibilities! So, if a client’s payment is past due, you definitely don’t want to let it slide.

Following Up

This may seem obvious, but you’d be surprised how uneasy some people get when they have to bring up tricky issues like money. Any kind of employee, but especially freelancers or those without strong roots in a company, don’t want to appear pushy or annoying. They want to seem like a flexible and understanding partner.

Never feel bad about asking for what is rightfully yours (especially since you’ve already completed the work).

Depending on the size of the client company, you may be dealing directly with a CEO, department head, or even a member of the finance team. Don’t forget that these are all busy people with a lot on their plates. Even though they should be organized and processed enough to not be tardy on approvals and payouts, things sometimes get in the way.

A gentle and polite email reminder (you shouldn’t come at the person with anger or accusations) never hurts, and you should do so on the first day of a missed payment. Letting things slide for a week or even a few days will only push it back further.

Incorporate a Penalty

Though this would need to be done upfront in your contract, don’t hesitate with adding terms that include an X% interest charge or penalty on late payments. It doesn’t need to be a large percent or fee, but something that feels reasonable and would be an additional incentive for the client to pay on time.

How to Set Expectations & Mitigate Issues

You don’t have a ton of control over the client as a freelancer, but there are definitely some steps and precautions to make receiving the correct payments on time (or at least not nauseatingly late) a consistent occurrence.

Make Terms Clear

As mentioned above, you will never have any leverage if you don’t make your terms clear upfront. Many clients may have a standard agreement with all freelancers when it comes to approving and processing invoices, but if their time-frame doesn’t work for you, ask if you can negotiate the terms.

It’s also critical to set a clear understanding around the terms. If the agreed-upon pay period is 30 day, then make sure everyone involved knows when those 30 days start. Is it 30 days after you issued the invoice (this should be the case)? Thirty days after the client receives or processes the invoice? Or 30 days after a client is paid by their client, meaning it would actually be 60 days before you see a penny?

Make sure everything is clear from the get-go, and put it all into writing! Handshake deals or verbal agreements won’t do you a lick of good, and a detailed, signed contract is always better than just confirmation in the body of an email.

Proper Invoicing

As a freelancer, we are sure you already make invoicing standard practice. Of course there are a number of different ways to go about putting together an invoice, and some of it will depend on the services you are providing and the type of client you are billing.

Some people choose special invoicing programs, which may be a good option if you have many clients or more complicated projects and rates to itemize. However, sometimes just a well laid-out and detailed PDF does the trick.

Regardless of invoicing style, it’s critical to include an accurate time log for all work spent on a client or project—whether you are paid hourly or on a retainer. (More on that in a bit.)

Frequency

It’s also critical that you invoice frequently. Whether your situation calls for monthly, bi-weekly, or project-based invoicing, make sure that you are timely in getting invoices to the right people for approval.

Failing to do so won’t just mean getting paid later, but it could cause charges to pile up. Trust us, no client wants an invoice that is much larger than expected. If you expect a client to respect you, then you must respect them in return—so always be on time with sending invoices!

If you expect a client to respect you, then you must respect them in return—so always be on time with sending invoices! Share on XAccuracy

In order to get what you deserve, be meticulous about documenting your work. As mentioned above, it doesn’t matter if the structure pays for actual hours or on a retainer, either way you absolutely must be tracking your time. (Though we would bet that if you are paid hourly that you are pretty invested in tracking your time already.)

That being said, time tracking can feel like a cumbersome task. It’s nearly impossible to man a timer as you exert your brainpower on other tasks. And you better believe that no matter how much ginkgo biloba you consume, you are never going to be able to remember exactly how you spent your time all day—let alone all week or month!

That’s why we at Timing have taken the guesswork (and human error) out of time tracking. With Timing, all of the time spent on your Mac is tracked automatically, so you can spend more time doing work (and making that cash!) and less time counting minutes.

Our app is designed so you can easily categorize your clients and projects, setting rules as you go. This ensures that time spent in an app, software program, document, on a website, or answering emails are all filed properly.

We still suggest doing a quick review at the end of each day (we make that easy, too, with our intuitive Review Screen) so that you can file away any floating time or manually enter any work time spend off your computer (phone calls, meetings, etc.).

What’s even better is that when it’s time to invoice a client, you can generate timesheets with the click of a button, making reporting a breeze.

What to learn exactly how? Click here!

The Bottom Line

As a freelancer, you are acting as the owner of your company. And as such, you should be protecting yourself and your work as a CEO would.

Don’t be afraid to speak up if a payment is late (or incorrect, for that matter), but of course do so in a respectful and matter-of-fact manner.

Because you’ve been tracking your time all along using Timing, you have solid proof and reporting of the time spent on a particular project or over the course of a time period for a client. This leaves little room for confusion or argument, making the client-freelancer relationship much smoother.

You’re your own boss, so you need to be your own champion as well!